As it is predicted that the supply-demand imbalance of lithium, an essential raw material for EV battery production, will continue, there is also a possibility that the spread of EVs will be slowed down.

S&P Global Platts (S&P Global Platts), a global energy information analysis company, announced on the 14th that lithium prices are soaring due to an increase in battery demand and a shortage of material supply. It is predicted that the lithium shortage will reach 220,000 tons by 2030.

According to Platts, the price of lithium soared 511% from $9,000 per ton (about 10.8 million won) in early February of last year to $55,000 (about 66 million won) per ton on the 9th of this month based on lithium carbonate, breaking new highs every day. During the same period, lithium hydroxide prices also increased by 380%. The price of cobalt hydroxide and nickel sulfate, which are other battery materials, has risen by 59.5% and 15.8%, respectively, during the same period, which is a particularly steep trend.

Platts cited the expansion of production and sales of electric vehicles in countries such as Europe and China as the biggest factor driving the rapid rise in lithium prices. As a result, the supply of lithium is not keeping pace with the increase in demand for batteries.

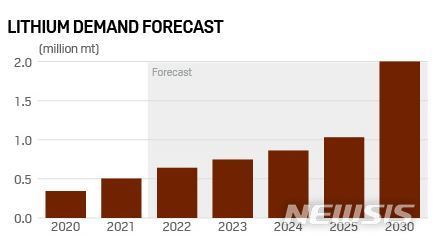

Sales of electric vehicles are expected to increase by more than 40% from the previous year to 9 million units this year, and close to 27 million units in 2030. Accordingly, lithium demand is also expected to increase from 500,000 tons in 2021 to 2 million tons in 2030. Among them, the amount of lithium required by the three domestic battery companies, LG Energy Solution, SK On, and Samsung SDI, is expected to reach 749,000 tons. This is a six-fold increase from 125,000 tons this year.

On the other hand, the lithium supply has not been able to keep up with the rapidly increasing battery usage as it has not yet entered the market in earnest as expansion and new projects are experiencing setbacks due to shortage of investment, labor shortages, transportation problems due to Corona 19, and regulations related to mining permits. For example, the lithium mine development project of Rio Tinto, an Australian mining company in the Zadar region of Serbia, met with severe protests because of environmental pollution during lithium extraction. Even the mining license has been revoked.

In 2030, lithium supply is predicted to be 1.78 million tons, 220,000 tons less than demand, and supply-demand imbalance is expected to continue. This is the supply amount calculated on the assumption that Platz meets the target production of 66 lithium producers, including Albemarle, Pilbara Mineral, Rivent, and SQM, of existing and new businesses in Australia, Argentina, and Chile. Considering the possibility of facing various difficulties, such as the suspension or postponement of the project, the difference is expected to widen further.

“Demand for lithium, which is critical for electric vehicles and energy storage systems, is expected to continue to grow as countries and companies around the world pursue carbon neutrality and accelerate the energy transition,” said Scott Yalham, head of battery metal benchmark pricing at Platts. “Lithium supply shortage is an obstacle for auto and battery makers to achieve their production targets, and along with the price increase of battery packs, there is a possibility of delaying the popularization of electric vehicles.”

[서울=뉴시스]