Recently, the “2021 Banking Digital Momentum and Financial Innovation Summit and the Seventeenth Publicity Year Annual Ceremony” organized by the China Financial Certification Center (CFCA) and more than 100 member banks was held in the cloud. The “2021 China Digital Finance Survey Report” (below) Called the “Report”) is also simultaneously released online. The “Report” shows that in 2021, personal mobile banking users will reach 2.05 billion, with a penetration rate of 85%, a year-on-year increase of 14%. The “Report” believes that mobile banking has become the most important online traffic portal for the banking industry, and promotion and customer retention have become the two major themes of the future development of mobile banking.

The number of mobile banking users reached 2.05 billion, becoming the most important online traffic portal for the banking industry

The digital transformation of the banking industry has entered a period of acceleration, and many banks have adopted mobile banking as the main output product of the financial technology front-end and the main starting point for digital transformation. Relying on platform construction and product design, banks improve customer experience, optimize operating procedures, strengthen user interaction, and create open platforms. Users can meet basic financial needs through mobile banking while gaining more user experience. Therefore, the rate of off-counter outlets has increased year by year. The penetration rate of mobile banking has also steadily increased.

With the increase in the penetration rate of mobile banking, the number of domestic mobile banking users has shown a spurt of growth. “Report” data shows thatFrom 670 million in 2014 to 2.05 billion in 2021, the user penetration rate reached 85%, a year-on-year increase of 14%. With such a large user base, mobile banking has become the most important online traffic portal for the banking industry.

For banks, in order to focus on building this portal, mobile banking is an efficient and convenient business processing channel. Banks continue to optimize mobile banking and update and iterate the version. In the past year, on average, banks have carried out 2.2 major version updates to mobile banking, of which up to 10 times.

Promotion and sticking to customers have become the two major themes of the future development of mobile banking

During the summit, Dong Ximiao, the chief researcher of China Merchants Finance and a part-time researcher of the Institute of Finance of Fudan University, pointed out that some banks have many registered users, but their active use is less. He proposed three aspects: strengthening daily operations, motivating active users, and improving user experience. Suggest.

According to the data reported by various banks, the “Report” shows that in 2021, the proportion of overall active customers of mobile banking will be around 40%. As a result, the “Report” believes that the promotion and sticking of customers have become the two major themes of the future development of mobile banking.

In terms of promotion and customer retention, the “Report” recommends covering high-frequency life scenes, enriching users’ frequently used and favorite life scenes, constantly improving the financial ecosystem, embedding financial services in various life scenes, and allowing users to live Financial needs are generated in the scene, which directly hits the pain points of users’ needs, increases users’ reliance on mobile banking, and effectively enhances the stickiness of mobile banking users.

In addition, the “Report” pointed out that, affected by the epidemic, mobile banking of various banks not only guarantees customers’ daily financial needs, but also provides a variety of epidemic-related financial and life services to increase user frequency and user stickiness, and cultivate users’ mobile banking habits. ; With the domestic epidemic under effective control, the frequency of use has not decreased significantly after the short-term financial needs of users have declined.

According to the survey data, various banks have been optimizing the operation process of mobile banking to provide users with a better user experience, so as to increase user utilization rate.

How does mobile banking retain old users and expand new users

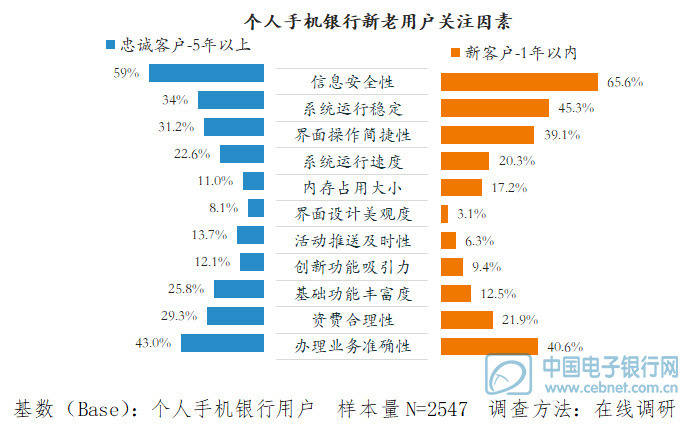

The data surveyed by the “Report” shows that new customers of mobile banking pay more attention to basic performance issues such as information security and system stability of mobile banking. Loyal customers pay more attention to the accuracy of business processing, reasonable tariffs and functions after adapting to the operation and logging in. Richness. Improving the basic operating experience can better retain new users; optimizing products and services to better meet the needs of old users can increase the user stickiness of mobile banking.

In the process of using the mobile banking APP, the problems encountered by new and old users are basically similar to the concerns. They are more concerned about security and operation issues. Loyal users are relatively more concerned about event push, memory usage and tariff issues.

The basic business of personal mobile banking is still the main use scenario for users

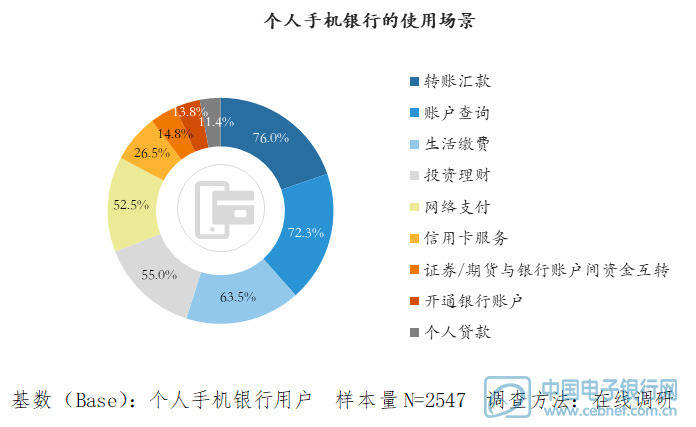

Research data shows that transfers and remittances and account inquiries are the businesses that users most frequently use mobile banking to handle. Both account for more than 70%. They are the most frequently used scenarios by users and are located in the first echelon; followed by living expenses at 63.5%. The second echelon; investment and financial management and online payment are 55% and 52.5%, respectively, in the third echelon. The mobile banking APP continues to iteratively upgrade, and the business that can be handled covers basic business, life services, financial investment and value-added services, etc., reflecting the bank’s concept of creating a mobile banking “ecosphere” scenario, and highlighting the empowerment of financial technology to integrate mobile banking and mobile banking. The strategic layout of a mobile financial platform integrating payment, mobile life and mobile marketing.

The good thing is that with the rapid development of financial technology and the continuous enrichment of mobile banking application scenarios, other business scenarios of mobile banking are also being accepted and used by users, especially life payment, online payment, investment and financial management, etc., new businesses The development of relying on basic business will provide a solid foundation for the rapid development of mobile banking.

Personal mobile banking is convenient and fast, favored by users, and security concerns are dispelled

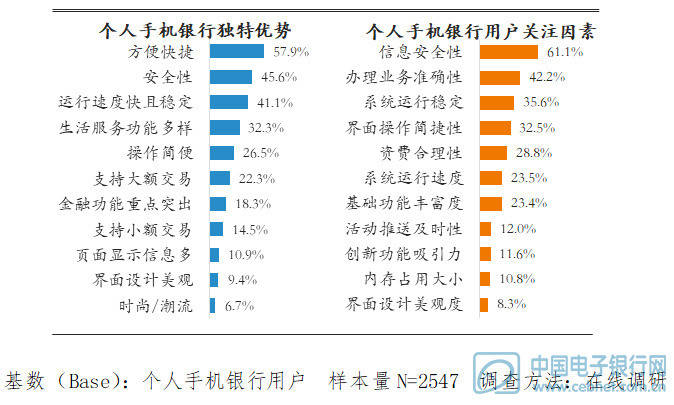

With the continuous development of Internet technology and online financial technology, the business functions of mobile banking are constantly updated and improved. Through mobile banking to break the time and space and geographical restrictions, users can conduct business anytime and anywhere, so convenience is the main reason for users to choose mobile banking.

Survey data shows that 61.1% of users say that information security is one of the most concerned factors when using mobile banking, which shows that security may indeed become one of the most important obstacles hindering users from using mobile banking.

However, the “Report” believes that from the current mobile banking security technology, while providing convenient financial services, comprehensive protection is strengthened. Therefore, in addition to continuous improvement of network technology, banks need to strengthen user security publicity and eliminate User concerns about safety.

Personal mobile banking needs to be integrated into life scenarios in an all-round way and cultivate user habits

Mobile banking has become the most important customer contact channel for banks, and mobile banking is becoming more and more homogeneous in terms of operating procedures and functional coverage.Constructing diversified application scenarios has become the main direction to attract users.From the survey data,Among the contents browsed by users using mobile banking, life services have kept pace with basic functions and become the most frequently browsed contents by users.

In the context of a large number of users but a low utilization rate, each mobile bank has moved from financial scenes to non-financial life scenes, and diverted users to high-frequency scenes through discounts, cooperative merchants, points, check-in and check-in, etc. Users generate demand for financial services in financial life scenarios, thereby increasing the activity of mobile banking.

However, the “Report” pointed out that “replacement” or “change” the habits that users have developed is a long-term task that requires a certain amount of time to settle. In addition, the construction of the scene ecology also needs to pay attention to the uniqueness and difference of the scene in order to have sufficient appeal to users.Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.